123

Can YB1 oncolytic bacteria shine in the pharmaceutical innovation R&D market as capital fuels the rise of biotechnology?

After the full ‘baptism’ of the epidemic, the respect for health and life sciences has never been stronger, and global capital is expressing its concern for the world’s future with the support of real money.

Since the global outbreak of the new crown epidemic, the perception and recognition of a “community of destiny” seems to have been upgraded several notches compared to the past. At the same time, this “community of human destiny” has never been more strongly committed to the health and life science and technology, evidenced by the interest and real money invested in the biotechnology industry by global capital in the past two years.

Now that 2021 is almost at an end, it is indisputable that looking back at the last two years of the biotech and pharmaceutical health sector, China’s leading biopharmaceutical and biotech companies are attracting global financial investors.

Industry tracking information shows that the M&A investment market in the life sciences and healthcare sectors both domestically and internationally was very active in 2020, and the Chinese life sciences and healthcare market, which is rapidly recovering from the new crown epidemic, has attracted many international capital injections, especially in the biopharmaceutical and biotechnology sectors.

Biotechnology continues to rise as global capital enthusiasm helps.

Despite the impact of the new epidemic, all industries were affected to varying degrees at the beginning of last year, but the biotechnology and pharmaceutical industry, as the pioneer in the “fight against the epidemic,” was one of the first industries to recover come back to life. Overall, last year was also a relatively active year for the life sciences and healthcare investment and M&A market, with the impact of the new epidemic and a series of favorable policies boosting M&A transactions in China’s life sciences and healthcare industry to show a recovery in the second half of 2020.

Industry report data shows that the number of M&A deals in China’s life sciences and healthcare industry reached 169 throughout 2020, including ultra-large deal cases with amounts exceeding US$1 billion, an 11.2% increase from 2019, with total deal value reaching US$21.3 billion. The statistics show that, excluding the ultra-large deals with a deal value of more than US$1 billion, the deal value in 2020 is 45.2% higher than the previous year.

On the other hand, financial investors also completed a record amount and number of investment transactions following 2019, due to the continued positive impact of the opening of the domestic Science and Technology Venture Board, the registration system of the SSE GEM, and the biotechnology sector of Hong Kong stocks, as well as the relaxation of new regulations on refinancing.

The HKEx and the STB are attractive IPO platforms for leading Chinese biotech and pharmaceutical companies. The information shows that four of the top ten private equity/venture capital deals in terms of deal value last year involved pre-IPO financing related to listing on the HKEx or the STB.

The favorable and supportive capital market is a great motivation for the booming biotechnology industry. Domestic biotechnology companies have actively started the capitalization process in recent years. Many unprofitable biotechnology companies have rushed to Hong Kong for listing or registered on the Mainland’s Science and Technology Venture Board, setting off a boom in the listing of biotechnology companies. The overall post-market performance of the industry is also quite good, indicating the positive response of the capital market to the biotechnology industry.

The biotechnology industry has continued to rise in recent years, thanks to the enthusiastic support of global capital, and the market has performed well. At the same time, the biopharmaceutical sector is gradually moving towards the path of innovation and is now shifting from a focus on copycat/imitation drugs to first-of-a-kind innovative drugs.

Innovative R&D drives rapid growth in the global pharmaceutical industry.

Driven primarily by an aging population and longer life expectancy, increased affordability, and the continued introduction of innovative medicines, the global pharmaceutical market has grown steadily over the past five years, from US$115.3 billion in 2016 to US$129.88 billion by 2020, at a CAGR of 3%.

Professional research reports predict that this growth trend will continue and that the total revenue of the global pharmaceutical market is expected to reach USD 1,711.4 billion by 2025, i.e., a CAGR of 5.7% from 2020 onwards.

Based on the status of patent protection, pharmaceuticals can be divided into patented and generic drugs. Industry research data shows that in the current global pharmaceutical market, the revenue share of patented drugs is significantly higher than that of generics, and the compound annual growth rate of patented drugs is also expected to outperform generics in the next five years. Overall, the market trend for patented or original drugs is better than that for generics.

(Source: Frost & Sullivan)

Innovative research and development has long been the main focus of competition in the pharmaceutical market and may even be the ultimate destination.

According to the data, as the global pharmaceutical market continues to expand, global pharmaceutical R&D spending has steadily increased from US$156.7 billion in 2016 to US$204.8 billion in 2020, representing a compound annual growth rate of 6.9%. The industry expects this growth to continue, with total spending expected to reach US$295.4 billion by 2025, or a CAGR of 7.6% from 2020.

Moreover, China has been playing an increasingly important role in the growth of global investment in pharmaceutical R&D over the past five years.

Currently, China is the second-largest pharmaceutical market in the world. Driven by an aging population, rising per capita disposable income, increased healthcare spending, and favorable government policies, the Chinese pharmaceutical market is expected to grow from RMB 1,448 billion in 2020 to RMB 2,287.3 billion by 2025, at a CAGR of 9.6%, much higher than the CAGR of the global and US pharmaceutical markets (5.7% and 5.2% respectively) over the same period. 5.2%).

The high growth potential of the Chinese pharmaceutical market is supported by strong investment in pharmaceutical R&D.

Statistics also show that R&D spending in China’s pharmaceutical industry will grow from RMB78.8 billion in 2016 to RMB170.3 billion in 2020, a CAGR of 21.3%, and is expected to remain strong and grow further to RMB342.3 billion in 2025, a CAGR of 15.0%, approximately double the growth rate of global R&D spending. It is approximate twice the growth rate of global R&D expenditure.

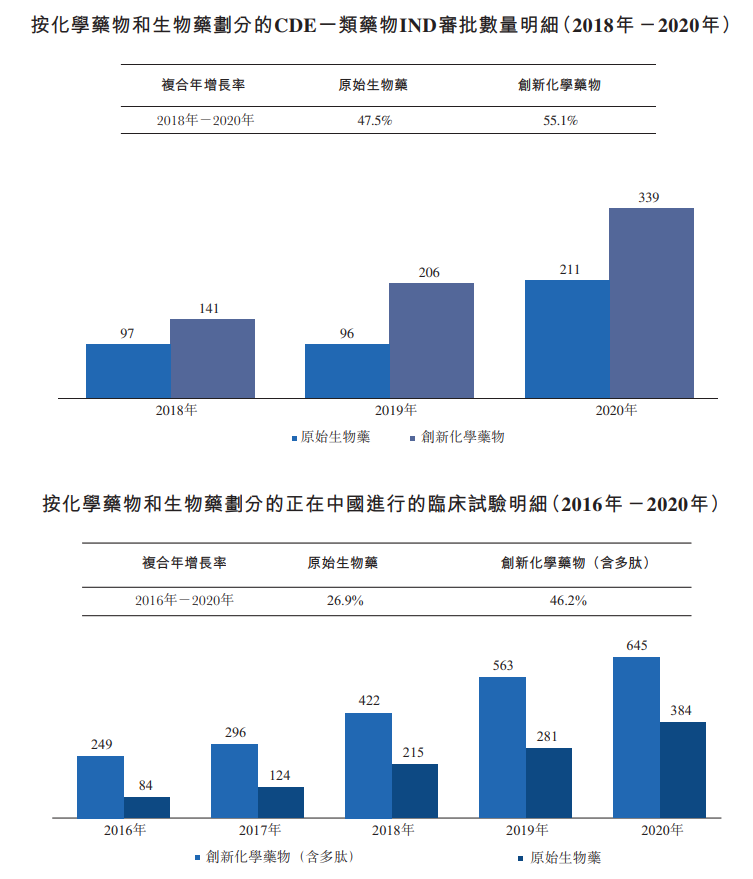

The strong and sustained investment in R&D in China is directly reflected in the exponential growth in the number of new drug clinical trial applications (IND) approvals and clinical trials. Innovative chemical drugs have shown steady growth over the past few years, reflected in the significant increase in the number of new IND approvals and ongoing clinical trials.

(Source: Frost & Sullivan report; Centre for Drug Review)

The government encourages innovation in the healthcare sector, with multiple innovative therapies in the anti-tumor field attracting attention.

In recent years, the government has emphasized encouraging innovation in the healthcare industry, and the momentum of innovation in the industry has not stopped in the face of the difficulties caused by the new epidemic since last year. It is fair to say that innovation has become the new normal in the Chinese pharmaceutical market. Right now, innovation in life sciences and biopharmaceutical development in China has shifted from “rapid follow-through” to “full-scale innovation” and is moving towards global “best-in-class” status.

Particularly in the promising oncology therapeutics market, driven by favorable government policy support and the emerging cell and gene therapy market, biological companies are increasingly focusing on the development of innovative drugs, with many emerging niche therapies emerging and industry players focusing on expanding their research and development capabilities and product lines, attracting a great deal of attention both inside and outside the industry.

Among the current hot emerging cancer treatment paradigms, oncolytic bacterial therapy is a cutting-edge research direction, and HKND, which has developed the world’s first oncolytic bacterial vector product, YB1, has attracted widespread attention from the industry market with its groundbreaking and innovative technological research results.

As an innovative R&D company focused on developing and applying biomolecular drug delivery systems, our core technology is the synthetic biology modified oncolytic bacterial vector YB1, which can deliver a wide range of biomolecular drugs with high efficiency. The company’s research team has demonstrated that YB1 can deliver a wide range of large molecule anti-cancer drugs, such as protein drugs, mRNA vaccines, antibodies, and oncolytic viruses, as well as a wide range of thrombolytic drugs for the treatment of various types of thrombotic diseases.

The team’s findings show that YB1 has strong technical compatibility, enabling compatibility with chemical drugs, immune checkpoint antibodies, and cellular technologies such as CAR-T, increasing efficacy and diversifying product pipeline design.

We currently have several pipelines of products in development for YB1 applications, including seven YB1 oncolytic bacterial pipelines for sarcoma, melanoma, and other solid tumours, and three YB1 thrombolytic bacterial pipelines for YB1-carrying recombinant urokinase (rt-PA), YB1-carrying recombinant defibrinogenase, and YB1-carrying fibrinolytic enzyme (plasmin). plasmin) in development for various thrombotic diseases.

As the YB1 technology matures and more and more innovative biotech companies in the industry move into broader markets, we believe that the global biotechnology and healthcare sectors will see new opportunities to achieve more advanced research results for the benefit of human health.

喜欢我的文章吗?

别忘了给点支持与赞赏,让我知道创作的路上有你陪伴。

发布评论…