Bitcoin ETF Mania: To the Moon or a Passing Fad?

In the last 2 months, the world has witnessed an unprecedented surge in the price of Bitcoin. Enthusiasts and investors have been holding their breath, driven by the optimistic belief that a spot Bitcoin ETF (Exchange-Traded Fund) might soon receive approval from the SEC (U.S. Securities and Exchange Commission). Just twelve months ago, Bitcoin was trading at a modest $16,000. But from mid-October, Bitcoin soared to $28,000. Fast forward to today, and it's now trading at an astonishing $41,000. The driving force behind this meteoric rise? The tantalizing prospect that a Bitcoin ETF could receive the coveted stamp of approval from the SEC in the coming months, igniting a frenzy of bullish hopes.

It's as though the crypto market has cleared away the haze, allowing the bull market to charge ahead with newfound vigor. Yet, amid this euphoria, I can't help but question the genuine demand for a Bitcoin ETF and whether it holds the key to unlocking the elusive mass adoption that the crypto community has long yearned for. But what exactly does a spot Bitcoin ETF open up, and what new demands will it drive in the world of cryptocurrency?

The Bitcoin ETF Frenzy

One of the primary advantages of a spot Bitcoin ETF is that it would make Bitcoin more accessible to a broader range of investors, or more specifically, asset managers. Traditional investors who may be unfamiliar with cryptocurrency exchanges or uncomfortable with managing digital wallets or have regulatory and compliance requirements that limit their ability to invest directly in cryptocurrencies, now could easily buy and sell shares of the ETF through their regular brokerage accounts. This increased accessibility could lead to a surge in demand for Bitcoin.

Ok, but just how much demand are we talking about here?

Taking a Page from History: Bitcoin Futures ETF

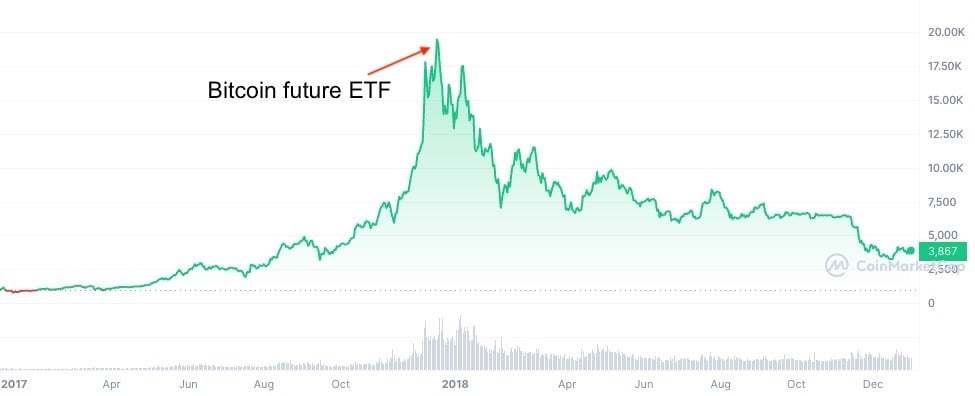

To gauge the potential impact of a Bitcoin ETF, let’s draw parallels from the history of CME Bitcoin futures. The introduction of CME Bitcoin futures in December 2017 marked a significant milestone in legitimizing Bitcoin as an asset class and played a crucial role in attracting institutional interest while providing a regulated trading environment. However, it's important to recognize that attributing the entirety of mass market demand to CME futures is an oversimplification.

CME's average daily trading volume of $1.85 billion, although substantial, pales in comparison to the tens of billions of dollars traded in the Bitcoin spot market. As such, it would not have had a significant impact on Bitcoin's price driven by this demand alone.

Interestingly, the initial excitement did lead to a remarkable 2,000% rally in the market up until the day CME futures were introduced, which marked the peak. Subsequently, a bear market emerged, resulting in an 84% decline in prices.

Source: Coinmarketcap

Historical Precedents: Gold ETF

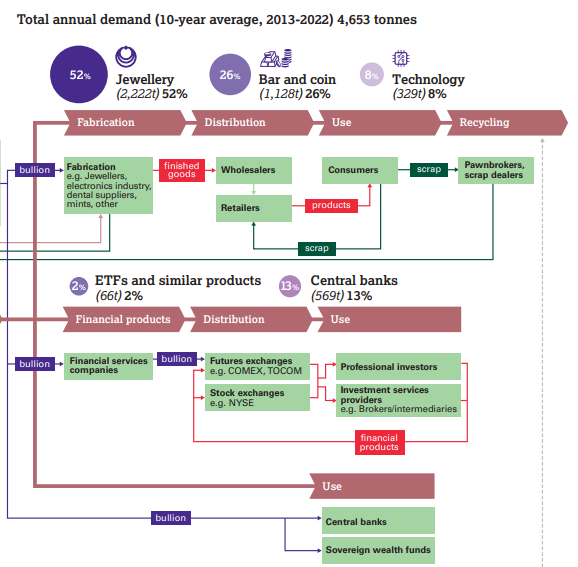

Another similar comparison can be Gold ETFs, which were introduced in the early 2000s and provided investors with a similar convenience - exposure to the price of gold without the need to own physical bullion. The introduction of Gold ETFs had a profound impact on the precious metals market.

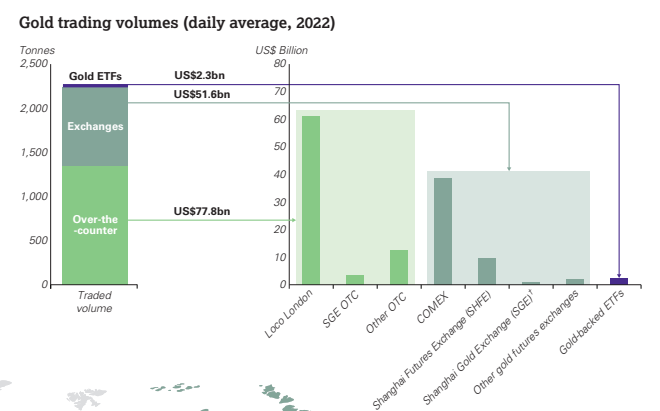

However, gold ETFs account for a relatively minimal amount of total demand for gold. The World Gold Council reported that gold ETFs held approximately 3,794 metric tons of gold. While this is a substantial amount, it represents only less than 2% of the total above-ground gold reserves estimated to be over 200,000 metric tons. The $2.3 billion daily trading volume of gold ETF shows similar penetration among total traded volume. But unlike Bitcoin futures, the price of gold rose four times from around $450 to $1,980 since 2004.

Source: World Gold Council

Source: World Gold Council

In short, the recent buzz surrounding the potential SEC approval of a spot Bitcoin ETF has triggered substantial price fluctuations within the cryptocurrency market. Yet, based on historical precedents such as the introduction of Gold ETFs and Bitcoin futures ETF, it's evident that these financial instruments haven't necessarily driven genuine demand, let alone sparked mass adoption. They might burst onto the scene with a lot of fanfare but then subside quickly, similar to the trajectory of Bitcoin futures ETFs or experience soaring highs akin to the journey of Gold. Ultimately, the pricing of cryptocurrencies often lacks strong foundational support.

喜欢我的文章吗?

别忘了给点支持与赞赏,让我知道创作的路上有你陪伴。

发布评论…