一個懶散的地球人

Some Thoughts For Tide Trust Network

White Paper: http://new.tide.ooo/white-paper/

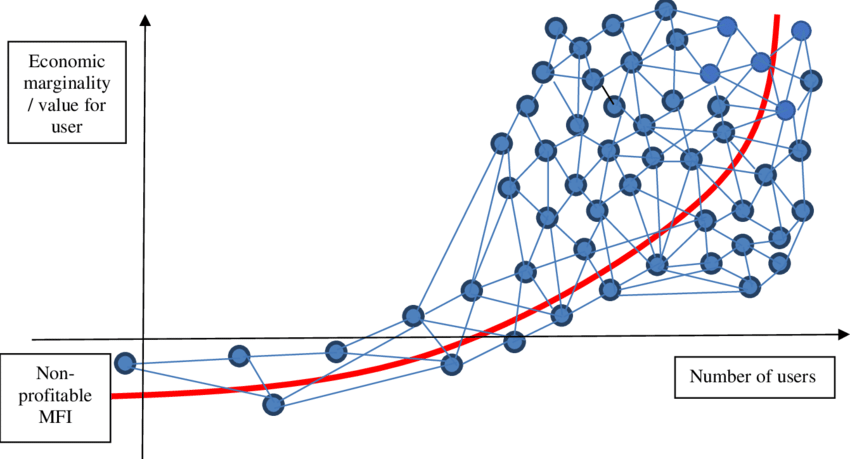

According to Metcalfe's law, we know the value of a network is proportional to the square of the number of connected users of the system. (N^2) Whether TTN will ever succeed is largely dependant upon how many projects/people will be in it.

Suppose we do an airdrop activity to random wallets in a month and we are no longer receiving aqua rewards. What gives value to Tide tokens by then? What motivates people locking their tide tokens in order to join TTN instead of selling them right away? If we can't find a reason, there is no way TTN will see greater adoption.

The only reason for people not to sell Tide token, is that "locking tide tokens and joining TTN will give me more utility than selling them for quick cash". If that is not the case, tide tokens will be sold and greater adoption fails. Real adoption has to come from incentives, not from hodling or cooperation within a small group of people.

So now we can do some brainstorming and try to think of possible merits of joining TTN, even though there is no project in it at the moment. Just pretend there are projects and services in TTN. My answer is:

“Tokens and Services within the TTN are more reliable than those that are not.”

Similar to logos we would see on various products like GMP, ISO/TS16949, ESG, UTZ, etc. We know these products are certified meeting various conditions. Logos like these have brand value. People are willing to pay some premium buying products with certification because these are perceived as more reliable with higher quality. If TTN can play such a role as some kind of certification network in the crypto space, then people will have incentives to join and there will be demand for Tide tokens.

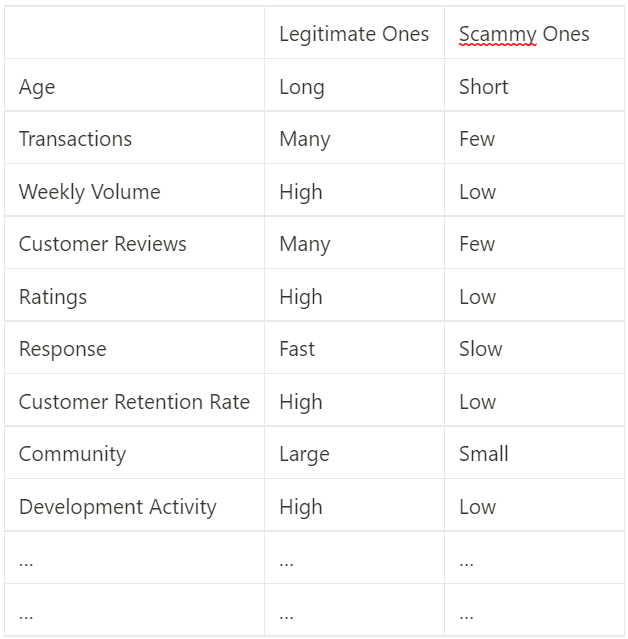

I don’t know what criteria makes a token / service trustworthy and reliable. I think this is a good topic for discussion and any idea is welcome. My impression is that 99% tokens in the crypto space are just scams. If we draw a comparison table between legitimate/scammy projects it should look like doing some type of fundamental analysis. People will be looking at projects and services within TTN from different angles using both qualitative & quantitative approach.

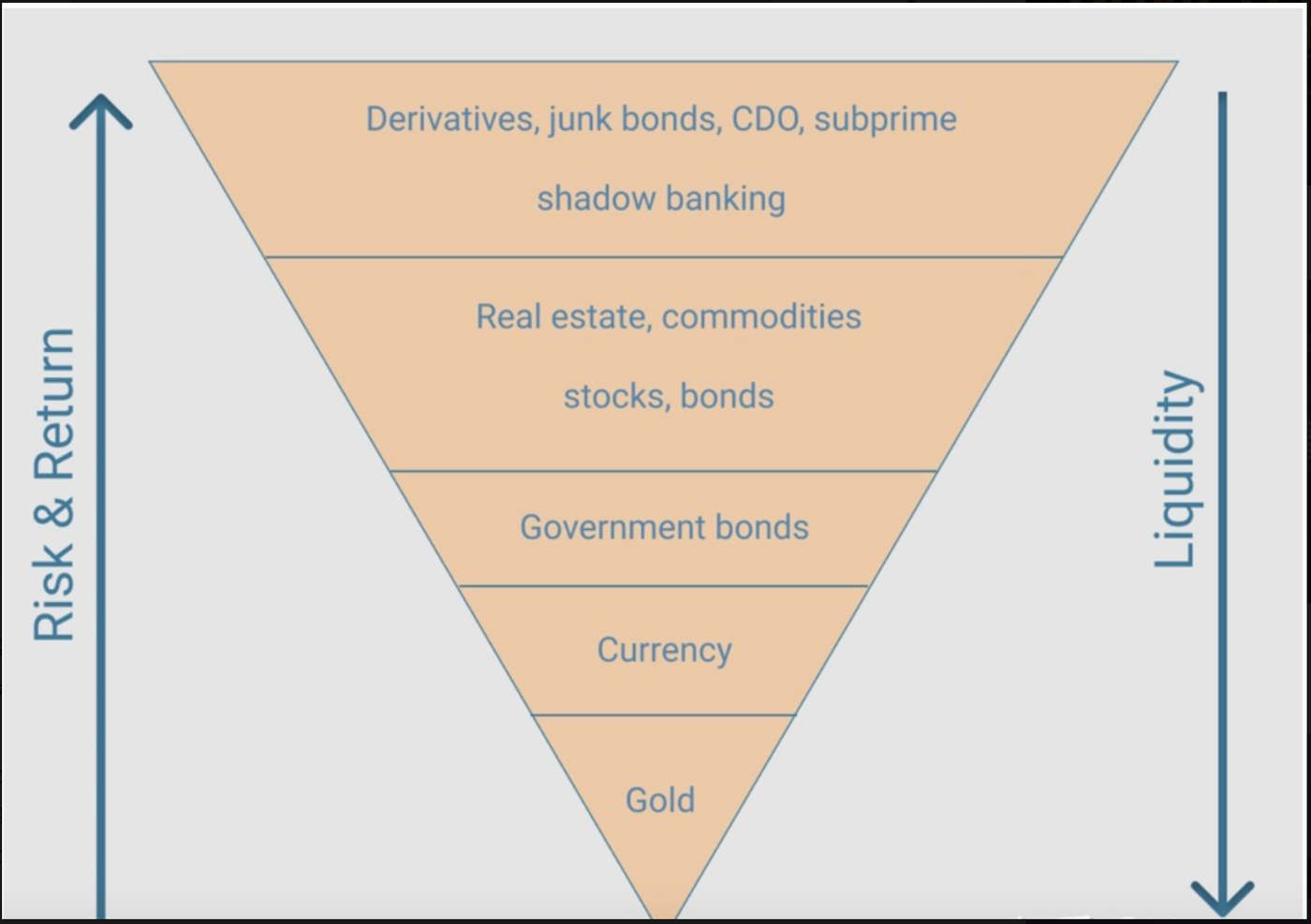

With regard to tokenomics. I haven’t come up with a good model other than what Alinor has said in this Discord channel and whitepaper. However I would like to share my view on the relationship among TIDE/MOON/XLM/BTC. There is this thing called Liquidity Pyramid proposed by an economist called John Exter. In human society, economic value is stored in the form of money. And at the very core and bottom value can be represented in the form of Gold. Even though today’s fiat currencies are no longer backed by Gold, psychologically we still perceive gold as a representation of wealth and resources.

Applying the same model to the crypto space, we would see that the relationship among TIDE/MOON/XLM/BTC should look like this.

BTC is the ocean that carries all boats (altcoins). Whereas adoption and economic activities of altcoins will add real value to BTC, making it more than a pure speculative asset. As of now I don’t see a clear use case for moon tokens. However after seeing some projects with dual-token economy like Axie Infinity and Stepn, I would say the distribution mechanism of moon tokens HAVE to be changed.

Many people see GameFi and XXX-to-Earn as nothing more than elaborate Ponzi schemes. Tokens like SLP and GST face infinite amount of sell pressure and their price will eventually fall to 0. I would argue these mined tokens are not Ponzi at all and are actually more legitimate than fiat currencies which can be printed out of thin air. In essence the algorithm behind SLP and GST is no different from Bitcoin’s proof of work. People need to pay effort to create SLP and GST.

In as much as the intrinsic value of Bitcoin can be measured in terms of electricity spent, the intrinsic value of SLP or GST can also be described as time and energy spent on playing video games or exercising. In other words SLP is proof of playing with Axies while GST is proof of calories. Following this logic I think moon should play a similar role in TTN using an algorithm called proof of trust.

What is proof of trust then? How should moon tokens be distributed so that we know people can only get moon tokens when they are trusted? Apparently voting for MOON/TIDE pool does not make anyone trustworthy. Trust needs to be earned not passively gained like staking tokens. I haven’t have a clear answer to this question yet. But I would say people tend to interact with stuff they trust. And people avoid having interactions when they don’t trust. For example if you see a great twitter/facebook post you will click the like bottom or subscribe/follow that user. Usually information and services are more credible if one can see tons of likes and repost even though that can be faked too. Moon tokens should be distributed according to one’s positive impression left on others.

That’s all I want to say for now. I can’t guarantee I will keep posting stuff on a regular basis or Alinor will come back building TTN. But I think most people here share the same feeling that the idea behind TTN is something that the crypto industry needs. My worst case estimate is that Alinor has left for good and those who still care about this project should just fork TTN issuing new tokens and airdropping to holders. I hope that is not the case because I don't have the necessary coding skills to do that. Anyway thank you all for taking your time reading my random thought.

喜欢我的文章吗?

别忘了给点支持与赞赏,让我知道创作的路上有你陪伴。

发布评论…