我是全球知名財商教育系統WYW的教練Wang Chih Wen,專門教導全球真正的財商教育,更給你工具應用。我以及我們的財商系統導師皆為財務自由,唯有財務自由的人,才有辦法教導你們達到財務自由之路。 FB: Work Your Wealth 亞洲被動收入大師 YouTube: Work Your Wealth 亞洲被動收入大師

【Financial Investment】 Warren Buffett sours on banks and invest in gold,Tony Robbins is also a gold enthusiast

rren Buffett secretly bought $563 million in gold assets for the first time in history!

Everyone on earth knows that Warren Buffett has never liked investing in gold. Warren Buffett has publicly stated that the fact that this metal cannot generate cash flow makes him see no value. In Warren Buffett’s words, gold and silver can do nothing but sit there and watch you .

Now that Warren Buffett has secretly bought $563 million in gold assets, has Warren Buffett changed his position and philosophy on gold?

2020 A year full of many variables. Warren Buffett has more than once before bluntly said that “gold is useless”. Max Keiser, a well-known American financial commentator, said: “Warren Buffett’s dumping of bank stocks and buying Barrick’s gold is a huge change, and its importance cannot be overstated.”

Warren Buffett was skeptical about investing in gold at several annual shareholder meetings and also in his letter to shareholders, but gold investment suddenly appeared in Buckshire Hathaway’s investment portfolio, and it could almost be regarded as avoiding risks to survive in difficult times. It is an indisputable fact that Warren Buffett bought a gold stock.

The price of gold for the year 2021 is expected to rise sharply, from the original US$1800 to US$2500. Analysts at Credit Suisse see a “perfect storm for gold” that will lead to $2500 per ounce next year.Credit Suisse (Credit Suisse) took this action and believes that the “perfect storm” including a weak US dollar, falling U.S. bond interest rates, and general inflation expectations have pushed up gold prices to record highs.

At the same time, John Paulson, a well-known hedge fund manager, disclosed that bought a new gold mining stock Equinox Gold in the second quarter, involving 2.5 million shares, valued at approximately US$30.6 million.

With the S&P 500 on the cusp of an all-time high, U.S. stocks are “fully priced,” according to the vice chairman of Blackstone Group Inc.’s private wealth solutions business,Byron Wien, who advises investors to buy gold as a hedge against further weakness in the dollar.

The economy, relying on policy support to sustain its momentum, remains far from a full recovery, with activity about a quarter of the level it was in 2019, Byron Wien,the vice chairman of Blackstone Group Inc.’s private wealth solutions business said in an interview on Bloomberg Television and Radio.

Byron Wien pointed out that the U.S. dollar has weakened. One way to protect yourself from this is to buy and invest gold . This year, gold has always been a good asset in the portfolio. He also believes that it is reasonable for individual investors to buy and invest some gold.

Tony Robbins, the world’s leading inspirational speaker, once warned of the risk of the devaluation of the U.S. dollar and talked about the opportunity for gold to “explode” and “in a bull market.”

Tony Robbins bullish on gold. Tony Robbins’s video “Deconstructed National Debt and Federal Budget Deficit” (2012) is very worth watching,

click [ Video ]. Tony Robbins told the importance of owning gold.

Most people who buy gold are rational economic people. They realize that there are macroeconomic, geopolitical, currency and system risks in the world, so they buy gold as a store of value.

They buy gold because they just want to protect themselves and their families from these risks by owning gold.

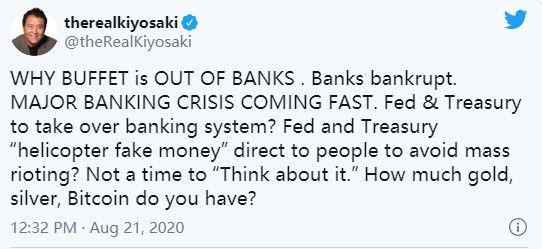

The author of the famous best-selling book 《Rich Dad Poor Dad》 Robert Kiyosaki continues to be optimistic about gold, silver and Bitcoin, saying that it is still an “excellent time” to buy more gold, silver and Bitcoin.

The author of 《Rich Dad Poor Dad》 Robert Kiyosaki said that the current huge debt and weak economy are real problems. If it is to be solved, the Fed must print money. Therefore, the author of 《Rich Dad Poor Dad》 Robert Kiyosaki considers it is an “excellent moment” to buy these assets.

The author of 《Rich Dad Poor Dad》 Robert Kiyosaki also said: “Savings are losers, cash is rubbish, and national bonds are selling their lives for the Fed.” As the global central banks have publicly announced that they will depreciate the value of cash by 2% every year, the author of 《Rich Dad Poor Dad》 Robert Kiyosaki told the investors do not to be losers. Open your heart and use your money wisely to invest in gold, silver and Bitcoin.

The author of 《Rich Dad Poor Dad》 Robert Kiyosaki predicts that gold will reach $3,000 in one year , and silver will rise to $40 in five years. Interestingly, since then, these two precious metals have indeed added value. The author of 《Rich Dad Poor Dad》 Robert Kiyosaki is more optimistic about Bitcoin’s predictions. The author of 《Rich Dad Poor Dad》 Robert Kiyosaki believes that Bitcoin will soar to $75,000 in three years.

This may be the last time you can buy gold for less than $2,000. What do you think? Be smart!

The year 2021 may be the beginning of a real financial turmoils, the effect has just begun now.Now that the global stocks have entered a bubble, stocks should be not be performing well like current situation and should be under-performing at this period but it is unusual for the government to keep printing money. Now if you get the profit, get out of the market as soon as possible. Do not be greedy. Take back the principal, and then invest the part of the profit in gold or other reliable projects.This is safer approach.

Learning is an investment that never depreciates.

Follow a reliable investment education system,learn financial knowledge, diversify risks, increase asset income, be a rational investor, rather than a speculative retail investor.

It’s time to grasp the pulse of this rapidly changing era, make the right choice at the critical moment, and get faster progress and a better life.

Like and Follow Facebook Page: Work Your Wealth International Investment Coach

©All rights reserved.

喜欢我的文章吗?

别忘了给点支持与赞赏,让我知道创作的路上有你陪伴。

发布评论…