Tell a joke, IPFS has zero popularity overseas

After tasting the sweetness from the DeFi outlet, Feifei is ready to ambush the next popular sector. There is no doubt that it is the IPFS-based storage sector. Of the ten in the circle of friends, nine out of ten are blowing IPFS. Since DeFi is dominated by overseas players, Twitter is the most used recently. Twitter is similar to domestic Weibo. Both Chinese projects and big V will open Weibo. Similarly, overseas projects and big V will also open Twitter. Twitter is The main social position for players in the overseas currency circle.

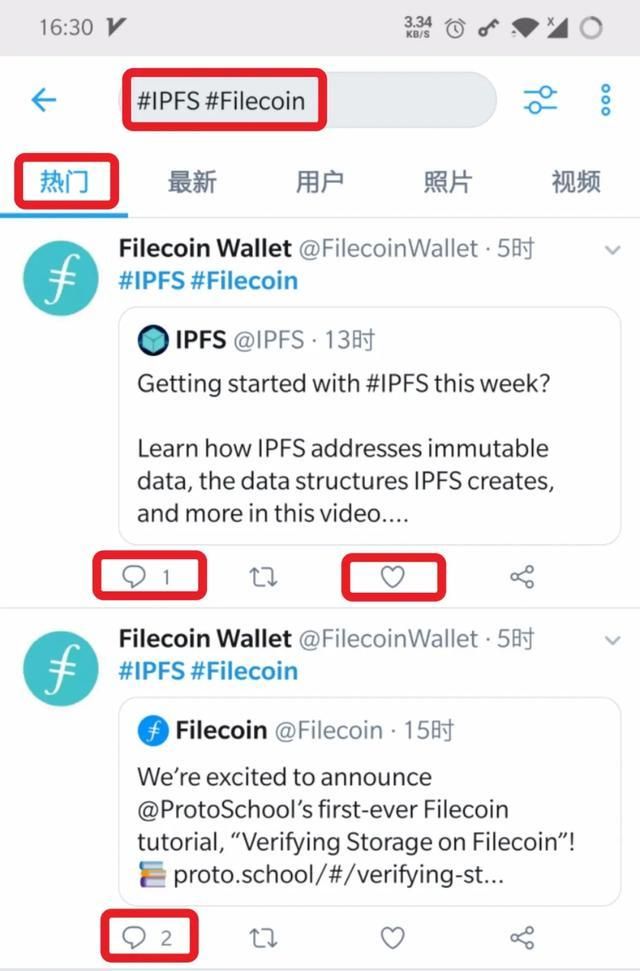

I was going to look at how IPFS and Filecoin are viewed overseas on Twitter. The result is very surprising. The popularity of overseas is almost 0. The most popular posts in recent days have single digit likes and 99% of posts are. 0 comments. Fatty even suspected that it was a mistake to type "IPFS/Filecoin". It was confirmed on the third day that IPFS/Filecoin really has no popularity overseas, and its popularity is less than 1% of EOS, which has fallen to the altar.

On the other hand, in the Chinese currency circle, almost no one knows about IPFS. Institutions, exchanges, big guys, and miners push IPFS as desperately as they did. Even a big guy has already called out FIL a hundred times. To put it bluntly, IPFS is a huge bubble created by the joint efforts of domestic scythes, which is tailor-made for domestic investors.

1. How did IPFS become popular?

Don't think too complicated about IPFS. It is a protocol, similar to the current TCP/IP protocol. Filecoin is a profitable project to make this protocol stronger. There are three main reasons for the emergence of IPFS in China:

1. The first driving force from the MLM fraud team. Feifei first learned that IFPS was at a conference in Wuhan and watched her aunt carrying money to buy an IFPS mining machine. The most famous of these scammers is undoubtedly the "Interplanetary Snail". The price of the Snail Interplanetary Mining Machine is as high as 5,875 yuan, and the machine with this configuration costs less than 1,000 yuan, and the final volume is more than 2 billion yuan.

2. The mining circle strives to find a new way out. First of all, Filecoin's reward mechanism attracts miners, and 70% of Tokens are mining rewards. For new miners, Filecoin has more opportunities than mainstream currencies such as Bitcoin and Ethereum. Maybe they will get the first bonus and become a flying pig. In addition, in the context of Bitcoin's production reduction and POS becoming mainstream, miners are too difficult to find new tracks.

3. A good concept + a good circle of money. The root cause of the explosion of IFPS is that this thing is too easy to collect money. It is sold in iron boxes and the concept of IFPS is so popular that you can hardly imagine it. There are also cloud computing power and FIL futures that the exchanges are peddling. For example, the FIL futures that have skyrocketed recently. Don’t look at their rise. In fact, most exchanges sell FIL futures out of thin air, and the exchange’s gross FIL spot will be taken when it expires. Does not come out. I made the money, goods? I do not have.

Therefore, those who hold FIL futures should run away.

4. The wolf has been hungry for too long and needs to eat meat. Since 312, the blockchain industry has been bleak. It’s not that DeFi has exploded recently. It’s a pity that DeFi has nothing to do with the Chinese currency industry. The main force of DeFi is overseas. The Chinese currency industry lacks a technical atmosphere and is mainly speculative. It can be said that DeFi is perfect. What should we do if the wolves have been hungry for too long? With the good concept of IFPS, a gluttonous feast begins.

2. Should I participate in IFPS?

Filecoin is expected to go live on the mainnet around August. Can you speculate on the premise that it is a bubble?

First of all, I do not deny the value of IFPS and Filecoin. This is indeed a serious project. IPFS has been implemented as early as 15 years. Filecoin completed a fundraising of 257 million US dollars in August 2017, setting the early stage of the global blockchain project at that time. Financing records.

Everyone wants to get in and share the pie, if someone makes a profit, someone loses. The Filecoin mainnet is online. The first batch of miners can indeed eat meat, but it is more of another possibility. The performance water of the miners you bought is just a pile of iron slag, which cannot be recovered by 18 generations. Book.

There is also the so-called cloud computing power that guarantees high yields. It is purely a rogue. It always claims several times the annualized yield. There are two factors affecting the yield. One is the total computing power. The greater the total computing power involved, the greater the output. The smaller the value, the second is the secondary market price of FIL. These two factors are both dynamic and uncertain. How does your cloud computing power guarantee a high rate of return? Who gives you the confidence?

In addition, after Filecoin goes online, there will not be too many real storage requirements. Don't talk about subverting centralized storage. Only after IPFS continues to scale, security and stability reach a certain level, then real commercial grade will appear. Storage requirements. In the end, it is still a question mark whether the so-called real demand will appear.

When you see a pack of wolves looking around in the IPFS market, and they are still hungry for a long time, how can we play with wolves, our sheep might as well hide first. Especially when the obvious risks are greater than the benefits, you should stay still and wait.

喜欢我的文章吗?

别忘了给点支持与赞赏,让我知道创作的路上有你陪伴。

发布评论…